OSINT Investigations Into Corporate Leadership Using DEF 14A

Learn how to find 'deep web' documents like the DEF 14A to help your OSINT investigations.

This article addresses the useful information that can be discovered in a company's "DEF 14A," also known as a Definitive Proxy Statement. This form is basically issued in advance of an annual shareholders' meeting in regard to matters that will be addressed at that meeting. These SEC filings often turn up a lot of useful information for analysts conducting OSINT investigations.

BACKGROUND: To obtain the DEF 14A you need to go to the Securities and Exchange Commission's database for company filings (known as E.D.G.A.R.). For further information on how to research a corporation, see the Corporate Research Project's Dirt Diggers Digest Guide to Strategic Corporate Research, LittleSis's research guide on Power Mapping Corporations, or the SEC's own guide on How To Research Public Companies. The DEF 14A identifies:

- key players in the company (directors, officers, major investors),

- biographies for each member of the board,

- potential conflicts of interest.

RESEARCH GUIDANCE

The record identifies the board (a.k.a. "board members" and "directors of the board"), the company officers, and each of these individuals holdings in the company. If you are investigating potential problems with a company, you'll want to start investigating these individuals as they are often the most influential players.

Fortunately, much of the work has already been done for you. Board members are generally elected annually and most of the candidates are current members that are running for reelection. This is maybe related to the fact that it is common practice for new board candidates to be chosen by the board itself. So the board itself often concludes that it should remain the board.

As part of the board's reelection campaign, a biography for each member is included in the DEF 14A. These bios generally identify each member's past and current places of employment in addition to other boards they sit on for companies, charities, and nonprofits.

This is the next place you should start researching. Look up each of these other institutions and research the board member's role in them. You can look up anything available on the relationships or any interactions between the first company and the other organizations. The goal is to see if the first company has any sort of unusual relations with another organization sharing the same board member.

If the other company is publicly traded, look up its SEC filings and references to the board member. A university-affiliated organization will likely have a webpage that will identify sources of funding and what kind of work it is doing. If it is a charity, lookup its cause to see if it is political. You can also lookup up the board member's social media accounts to identify personal connections to these and other outside organizations.

Finally it is also a great idea to search the board member's name in opensecrets.org and littlesis.org. Open Secrets has a great database that can reveal involvement in political activities and Little Sis exists to identify links among influential people.

It is worth noting that if you find something, try to get a baseline for the first company's normal interactions and relations with other organizations. The point is to prove that whatever you found is not simply "business as usual."

EXXON MOBIL CASE STUDY

This is a step-by-step guide for researching members of a corporation's board of directors. This case study will focus on Exxon Mobil's board. We will look into two directors and identify areas where a researcher can find more information.

The best place to start researching a board of directors is the corporation's S.E.C. filing DEF 14A "proxy statement."

For this article we will use Exxon Mobil's 2019 DEF 14A (obtained from the Securities and Exchange Commission website sec.gov). With the Exxon Mobil proxy statement, we find the list of directors on the first page after the Table of Contents in what is referred to as the "proxy summary and voting map." This is a quick summary of the board members. This is provided because it is intended as the list of candidates for shareholders to vote on for the next year's board. Given the board's influence over future candidates, it is no surprise that all of the nominees are already on the board.

The compensation in cash and stock options is listed for each director for the previous year.

In addition to the board members, the proxy statement also identifies other influential parties, including major investors and the executive officers. Here we see that The Vanguard Group owns 8% of Exxon Mobil's outstanding stock. We also see the names of the executive officers and the stock ownership of each director and officer.

This document expands on each of the directors in "Item 1" for the shareholders' meeting, which is the voting on the directors. See this example below on one of the directors, this is a great resource for identifying different links to other organizations. We see that she currently works at the Woods Hole Oceanographic Institution and her background includes a lot of focus on academic institutions.

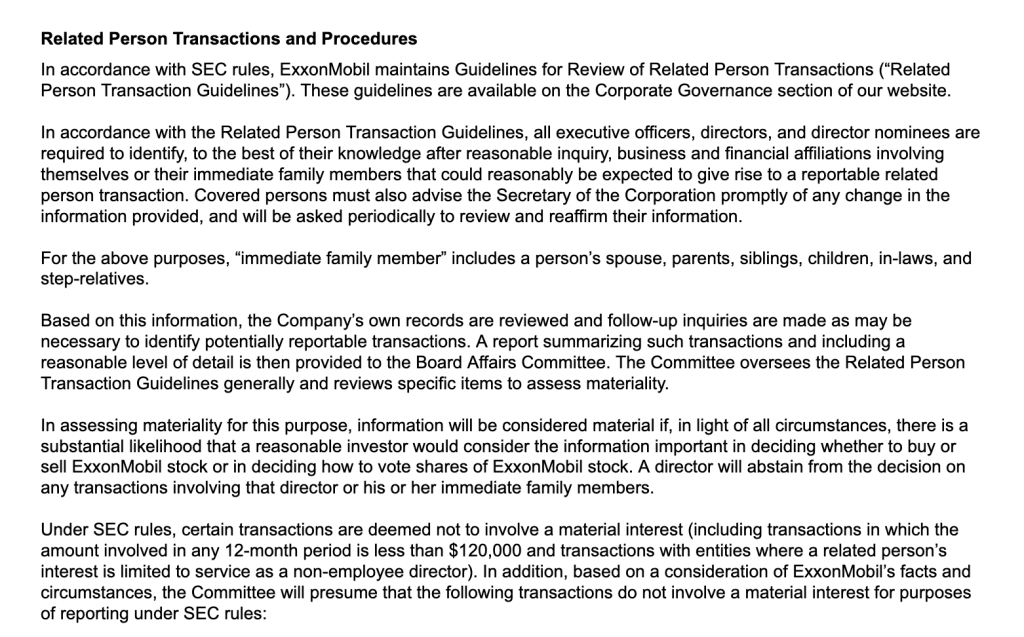

The "corporate governance" section of the proxy statement is often where interesting bit of information are located, in part because the company has to acknowledge certain things that it does not want to acknowledge. This includes its policies on conflicts of interest, including what it considers to NOT be a conflict of interest, as well as certain issues that could be considered conflicts of interest.

Companies often make vague references to possible areas of concern in this section. Sometimes an issue has occurred and the company does not want to be seen hiding this issue but at the same time they do not want to be unnecessarily forthcoming with information. The following may or may not be such an issue, but it is interesting to look at nonetheless.

DIRECTOR INDEPENDENCE

The section on Director Independence is often a good place to start looking for directors with interesting connections. This is where corporations often make passing reference to strange links. The purpose for the company is to acknowledge the strange link and assure the shareholders that everything is fine. While this could be true, it could also be a great place to start investigating.

Here in the Exxon Mobil filing at the very end of the Director Independence section there is passing references to three possible areas of concern. The board is saying that it looked at some "transactions, relationships or arrangements" and it decided that there was nothing of concern. This article will look at the 3rd area of concern at the bottom of the list.

We see at the bottom of the list that one of the directors was involved in "ordinary course business with MetLife (purchases of employee life insurance and other benefits." It is hard to say if there is actually anything interesting behind this quote, but there are some measures that can provide more information.

The next step is to look up the director's biography, and we see that he is in fact the CEO of MetLife.

A google search of "exxonmobile" "metlife" yielded a page on Exxon Mobil's employee benefits, and lists that MetLife life insurance is offered to Exxon Mobil employees. This could be the aforementioned "ordinary course of business." It is not yet clear if this is relevant.

Notably, the most recent def 14a proxy statement for MetLife actually states that he is leaving the company. Nonetheless, a word search for the director's name in the document shows multiple hits. The document identifies several elements about the director's leadership strategies and efforts throughout his time at MetLife. Note that this commentary is written overwhelmingly in director's favor, but regardless of subjective aspects to the commentary it is still possible to glean objective facts. Also, the director's compensation is listed in detail.

FURTHER RESEARCH STEPS

Following the steps recommended earlier, we can look up the director via def 14a forms for his other companies and IRS 990 forms for his positions on nonprofits. The most recent AECOM proxy statement has another biography for director with similar and additional information. For example, this biography provides some new information, including background on director's education (that is relevant for us because board members often become involved in their alma maters) and informs us that he was a founder at Orion Partners. Each of these may provide new access points to research.

Moving on from the business realm, we see that the director's biographies reference him having a position in the nonprofit Damon Runyon Cancer Research Foundation. Using Propublica's Nonprofit Explorer, we can look up the most recent IRS form 990 for the Damon Runyon Cancer Research Foundation.

Remember that tax filings for nonprofits in the U.S. are publicly available and include all sorts of useful information ranging from names of contractors, expenses, donations, and board members.

The director's name appears only once in the form and it says that he was one of about twenty directors who all worked one hour per week (the minimum that can be input) and received no compensation. Given this information alone, it is not clear how much work the director does for this organization. However, given that the director officially works the minimum amount of time for this organization and works for free, it is certainly possible that the director does not do much for this organization. If so, that would mean this is a bit of a dead end research-wise.

However, the Nonprofit Explorer also allows you to search on a particular person's name. Doing a name search on the director identifies several nonprofits where he is listed. See below for some examples. Each of these hits can provide a great avenue for future research.

There are many directions where one can take the investigation from here, but it makes sense to see if someone else has already done some investigating. So it is worth checking LittleSis.org for any information on the director's connections. We find that he does appear on the site, with his own page on him.

LittleSis.org is a great site for finding connections and one could easily get lost researching the different links emanating from a single person like the director. While some material may overlap with the proxy statement biography, if you scroll down you quickly discover some material that is definitely not on the proxy statement, the director's political donations. Remember that the board writes the proxy statement so it will definitely try to portray itself positively.

Viewing the data in LittleSis shows that the director took a rather public position on the New York City Democratic National Committee Host Committee. However, the "political" section of the page shows that the vast majority (over 95%) of his political donations went to Republicans, vice Democrats. This may or may not prove relevant, but it interesting to note.

If there wasn't information on the director in LittleSis, you could still look up data on his political donations by using the Donor Lookup tool at OpenSecrets.org.

EXXON'S GOOD GOVERNANCE

Now returning to our researching Exxon Mobil's 2019 DEF 14A "proxy statement. Regarding the Corporate Governance section of Exxon Mobil's DEF 14A, if one has the time to read through it, this section lays out the company's policy on conflicts of interest. This is very important because it also identifies, implicitly or explicitly, what kind of activity the company will NOT consider a conflict of interest. Therefore, that is exactly the kind of information that one can start seeking out. First of all, low-level conflicts of interest can lead down the path to high-level versions. Secondly, it is worth identifying low-level conflicts of interest to the extant that it reflects on the company and possibly confirms that there is no high-level versions taking place.

Exxon Mobil provides a fairly standard policy on corporate governance and preventing "related person transactions," which are basically areas where there is a conflict of interest. These can be very specific, such as Exxon Mobil's detailed definition of "immediate family members."

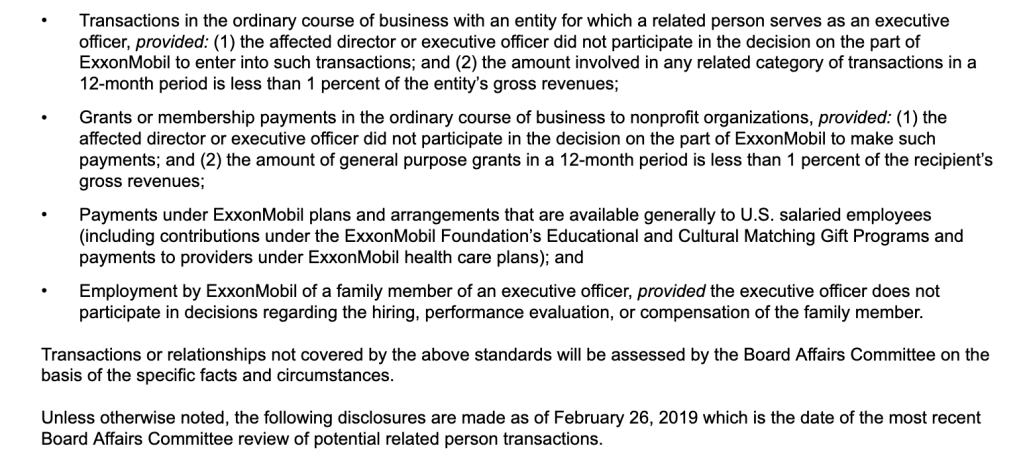

What is most interesting is the part where the company specifies how it defines what actions it perceives as acceptable. In the last paragraph in the section below, Exxon Mobile points out that SEC rules allow for "certain transactions" that are worth "less than $120,000." This is noteworthy

Exxon Mobil also lists our various other criteria that it deems acceptable. For example, the first bullet below states that Exxon Mobil is okay with doing a business deal with another company where an Exxon Mobil executive is related to an executive in the other company. Exxon Mobil maintains that this is acceptable as long as the Exxon Mobil executive was not responsible (in my opinion, that should read "officially responsible") for the deal and the deal is worth less than 1% of the other company's gross revenues.

Regardless of Exxon Mobil's and the SEC's policies, this criteria leave a lot of leeway in one's activity here and this could be the basis for further research.

You can apply these steps to any publicly traded company without needing additional knowledge or understanding of the corporate world. Good luck with your investigations.